Happy New Year from everyone at #TradeViews!

2026 could be the year the EU–Mercosur agreement finally comes to fruition after 25 years of negotiations. Amid rising EU–China trade tensions, the Cyprus Council Presidency has set its trade priorities straight. Finally, 2026 is shaping up to be a year in which the intersection between trade and non-trade policies takes centre stage.

EU-Mercosur: the never ending story

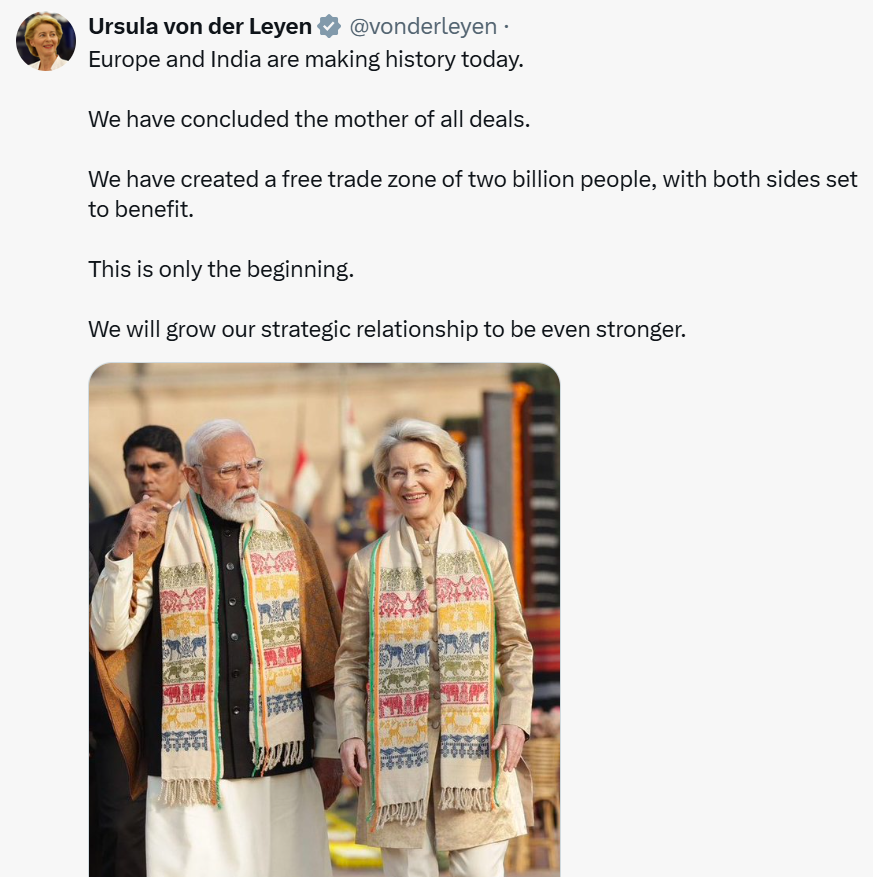

January was an exceptionally busy start to the year for EU trade, headlined by the historic signing of the “mother of all deals” with India—a landmark agreement uniting a market of nearly two billion people. While February may lack such “flamboyant” announcements, it promises to be a decisive month for the future of #Mercosur, Multilateral trade and Transatlantic relations.

The mother of all deals: A new chapter in EU-India relations

Last week was a busy one in Davos, Switzerland, as world leaders took part in forward-looking discussions on global challenges and priorities. In a speech on trade diversification, European Commission President, Ursula von der Leyen, said the EU and India were “on the cusp of a historic trade agreement […] that would create a market of 2 billion people, accounting for almost a quarter of global GDP.”

One week later, the long-negotiated deal — nearly 19 years in the making — was officially concluded during Ursula von der Leyen’s visit to New Delhi. In her words, “India and Europe are trusted and reliable strategic partners. We stand together. United in our commitment to help our businesses endure, thrive and grow”. The landmark EU-India Security and Defence Partnership brings together the world’s second and fourth-largest economies. Nicknamed “the mother of all deals”, it cements the EU as one of India’s biggest trading partners and opens up a traditionally protectionist Indian economy of 1.4 billion people. The trade deal will cut or remove tariffs on over 90% of EU exports to India, saving European businesses around €4 billion a year and potentially doubling exports by 2032. Key sectors like cars, machinery, chemicals, pharmaceuticals, wine and spirits will benefit from major tariff reductions, while sensitive EU agricultural products such as beef, rice and sugar remain protected. Nevertheless, Indian imports will still need to meet strict EU safety standards, and European consumers will gain access to cheaper Indian goods like textiles, gems and medicines.

This trade deal comes at a time when geopolitical tensions are on the rise between the EU, India, and the United States. Driven in part by an escalating tariff dispute that has hit both New Delhi and Brussels, the deal sends a strong message that cooperation is the answer to global fragmentation.

Our Take:The EU-India agreement promises to be more than a trade deal. By locking in the world’s fastest-growing major economy, Brussels has moved beyond mere rhetoric to create a democratic counterweight to global fragmentation and an increasingly unpredictable Washington.

Zoom in: Once signed, the deal will need to be ratified by the European Parliament and get final approval from the Council, a process that could take at least a year. While not as contentious as the EU-Mercosur Deal, trade expert, Nicolas Kohler-Suzuki, warns that concerns over the enforceability of the environmental and social commitments may make Parliament delay ratification.

Zoom out:Total trade between the EU and India has seen a significant surge in the last years, reachingover €120 billion in 2024 and accounting for nearly 11% of India’s total merchandise trade. This number is expected to grow significantly with the removal of duties.

An arctic standoff

The future of transatlantic trade relationships might be decided in the Arctic. After weeks of not-so-subtle statements on the acquisition of Greenland and threats of additional tariffs on six EU countries plus the UK and Norway, US President Donald Trump has now taken a step back, following the conclusion of a mysterious framework agreement on Greenland with NATO.

Currently, the content of the Greenland agreement remains elusive. NATO chief Mark Rutte referred to a security cooperation agreement, without any mention of Greenland or Denmark renouncing their territorial rights – while telling MEPs to “keep on dreaming” if they thought Europe could defend itself without the US. According to Washington, the deal introduces a permanent safeguard for American interests in the Arctic, with economic, defence, and strategic repercussions. Notably, Trump stressed the importance of Greenland for his Golden Dome missile defence system and is likely eyeing Greenland’s reserves of strategic minerals for the tech industry, currently controlled by Nuuk.

However, while Trump’s threats appear to be a thing of the past – at least for now –, Brussels is growing increasingly diffident of its transatlantic ally. On 27 January, the European Parliament’s International Trade Committee postponed to 4 February a vote to resume the implementation of July’s UE-US Joint Statement on trade, on hold since 16 January. While the S&D, Greens, and Renew Groups asked for clarity on the Greenland agreement before the vote, the EPP, ECR, and PfE called for works to resume quickly.

In the Council, despite an initial push by some Member States (notably France) to activate the Anti-Coercion Instrument (ACI, aka “Trade Bazooka”) against Washington, Capitals have adopted a more moderate position after Trump’s step back, while standing ready to adopt necessary trade countermeasures, including revamping imposing tariffs on €93 billion-worth of US goods and the ACI.

Mercosur and the Politics of Pause

Needless to say, Europe has a Mercosur problem. But it is no longer just about trade.

After 25 years of negotiations and the signing of a landmark agreement, the European Parliament sent the EU-Mercosur deal to the Court of Justice just days later. On January 21, MEPs voted in plenary to request an opinion to the CJEU on the agreement’s legal basis. The result is an uncomfortable limbo: the deal was signed, celebrated by the Commission, and then effectively put on ice.

The referral was supported almost unanimously by far-left and far-right political families, as well as by the Greens, while the ECR, S&D, and EPP split along national lines, as so often happens with the EU-Mercosur deal.

While anti-Mercosur MEPs celebrated, many policymakers warn that the decision risks undermining the EU’s credibility as a negotiating partner, as the deal may now face a potential two-year delay. German Chancellor Friderich Merz called the decision a “geopolitical misjudgement”, a frustration shared by INTA Chair, Bernd Lange, on LinkedIn. For Mercosur countries, it raises fresh questions about whether the EU can be relied on to follow through on its commitments. For Europe, it reinforces an image of uncertainty precisely where clarity matters most.

Because in today’s trade environment, credibility is built through action, leverage grows through speed, alignment, and most importantly – presence. Right now, prolonged uncertainty — not decisive leadership — risks becoming Europe’s defining signal.

Is the ‘Most Favoured Nation Principle’ Still the Most Favoured Rule?

Has the Most Favoured Nation principle become “a straitjacket that locks in the status quo and enables free riding”? EU Trade Commissioner Maroš Šefčovič raised this question in a Financial Times opinion ahead of the Davos trade ministers meeting.

Under the WTO’s MFN principle, any trade advantage granted to one partner must be extended to all members, while developing countries may still benefit from preferential treatment. Yet, the reality on the ground often tells a different story. Citing members that have expanded their share of global trade while keeping markets relatively closed, Commissioner Šefčovič is now calling for a shift toward genuine reciprocity and fairer competition. This is not the first time Šefčovič has spoken about WTO reform, but unlike before, his focus now seems less about integration and more about recalibration.

Šefčovič’s arguments mirror positions advanced by the United States in its December communication on WTO reform, where Washington argued that distinctions between developed and developing economies have blurred and called for allowing bilateral agreements that would not automatically apply to all members.

The opinion raises questions about whether the EU, a longstanding defender of multilateralism, is signalling a shift towards differentiated treatment, or merely seeking to recalibrate the MFN principle to address challenges such as Chinese overcapacity. Attention now turns to the WTO ministerial meeting scheduled for March in Cameroon, where ministers are set to discuss the challenges and opportunities facing the multilateral trading system and define the future work of the WTO.

EU – Ecuador Lowkey Doing Business

The EU has just concluded, in a very discreet manner, the negotiations for a Sustainable Investment Agreement with Ecuador. The deal, the first of its kind with a South American country, aims to boost reciprocal trade by easing regulatory uncertainty in cross-border investments and bureaucratic hurdles.

Being Ecuador’s largest trade and investment partner with exchanges worth around €7.6 billion in 2024, the EU plays an increasingly important role in the country’s economy. Like the EU-Mercosur deal, this agreement signals a renewed effort by EU institutions to increase their presence in South America.

Eurocratically dubbed as “SIFA”, the agreement will simplify investment authorisation procedures, enhance transparency and predictability through stakeholder consultation and online authorisation procedures, and facilitate the relation between investors and public administration through the creation of focal points.

The deal comes with sustainability guarantees, with both parties committed to not weakening environmental or labour laws and to promoting responsible business practices.

The text of the agreement will now be submitted to the Council for signature, before being sent to the Parliament for ratification.

Over on X

Just like your friend who’s taking a “spiritual break”

On our radar.

February 9-12 | All eyes turn to Strasbourg from February 9–12, where MEP Gabriel Mato will present his report on the proposal for bilateral safeguard clauses of the EU-Mercosur Agreement. Additionally, Michał Szczerba will publish a report on the current state of EU-US political relations, and the Parliament will hold a high-level debate on foreign affairs issues.

February 23-24 | Attention will shift to the European Parliament’s INTA Committee, where MEPs are expected to debate potential safeguard clauses linked to the EU–U.S. trade agreement. Discussions will focus on strengthening suspension mechanisms in response to renewed tariff threats or challenges to territorial sovereignty, following concerns over President Trump’s past remarks on Greenland.

What we are reading

CBAM Comes of Age. In the latest episode of The Sound of Economics, hosted by Rebecca Christie at Bruegel, the discussion turns to how the EU’s Carbon Border Adjustment Mechanism is moving from theory to practice. Bruegel experts Ignacio Garcia Bercero and Ben McWilliams explain when companies will start paying, which countries and sectors are most exposed, and how CBAM is meant to curb carbon leakage.

Internal Market Fatigue. In a recent article titled “Trade between EU member states is slowing, data shows,” the Financial Times highlights a concerning trend: trade within the bloc has dropped dramatically in the last year. This slowdown underlines the nuanced reality of the EU’s trade strategy, suggesting that The EU can’t rely only on new trade deals with countries like India or Mercosur to boost its economy. For those partnerships to really work, the EU also needs to fix and strengthen its own internal market — making it more competitive, efficient, and resilient at home.